Participant Support

Participant support costs are direct costs for items such as stipends, subsistence allowances, travel allowances, and registration fees paid to or on behalf of participants or trainees (not employees) in connection with conferences or training projects (2 CFR 200.75).

Participants are recipients, not providers, of a service or training associated with a sponsored workshop, conference, symposium, or other training activity. Participants (aka trainees) often include students, scholars, and individuals from the public or private sector such as teachers.

Unlike employees on a sponsored award, participants do not have an obligation to meet a scope of work or produce an outcome. Conversely, employees, trainers, and conference speakers and organizers have an obligation to deliver, therefore they should be budgeted under ‘Personnel’ or ‘Other’ and not under ‘Participant Support.’

Participant support costs should not include:

- payments to employees on the same award,

- payments for conference organizers, facilitators, and speakers,

- general collaborators including non-CSU co-PIs,

- incentive payments to human subjects,

- costs for room rental fees, catering, supplies, etc. related to a sponsored conference or training project.

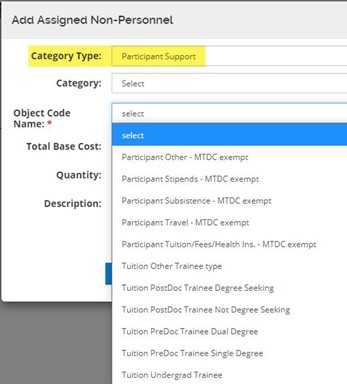

Costs for participant support should be budgeted under the ‘Participant Support’ category and exempt from indirect costs. In KR PD, select the Category Type ‘Participant Support,’ then select the appropriate Object Code Name: Other – MTDC exempt, Stipends – MTDC exempt, Subsistence – MTDC exempt, Travel – MTDC exempt, or Tuition/Fees/Health Ins. – MTDC exempt.

Like all costs in a budget, it is important to properly categorize costs at the proposal stage. Costs awarded as participant support are generally restricted and may not be allocated to other budget categories without prior written approval of the sponsoring agency. As previously mentioned, participant support costs are excluded from calculating indirect costs when using a Modified Total Direct Costs (MTDC) base, so mis-budgeting or re-budgeting these costs have a direct impact on indirect cost recovery.

To appropriately track and manage participant support activity, a separate account is created and coded to not incur indirect (aka, F&A) costs. Budget in these accounts is restricted and may not be reallocated out of the separate account without prior written consent of the sponsoring agency. Unexpended balances left in a participant support account at the end of a project become de-obligated and cannot be used to offset expenses in the parent or other related project accounts.

Participant (Human Subject) Incentives

Participants incentives are payments to individuals to motivate them to participate in research or service. Investigators offer incentives to help improve subject recruitment and retention. Incentives may be in the form of a cash payment or gift card, or they may be non-financial such as class credit, raffle entries, or promotional items as allowed by CSU and the sponsor. Cash incentives should not exceed $100 per incentive or $599 during a calendar year.

Costs for participant incentives (aka human subject incentive payments) should be budgeted under ‘Other’ and should be included in the human subject protocol that is approved by CSU’s Research Integrity & Compliance Review Office (RICRO). Unlike participant support payments, participant incentives do incur indirect costs.

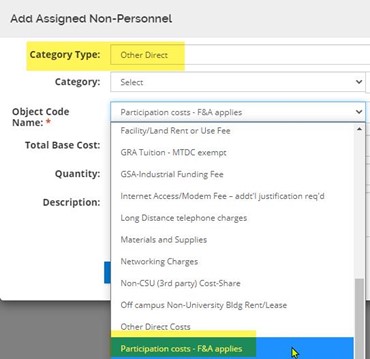

In KR PD, select the Category Type ‘Other Direct,’ then select the appropriate Object Code Name: Participation costs – F&A applies.

Other payments related to human subjects may include reimbursement for out-of-pocket expenses (e.g. travel, parking, meals, lodging) and compensation to offset the time and burden to research participation. Like incentive payments, payments for reimbursement and compensation should be budgeted under ‘Other’ and are subject to indirect costs.

Costs for incentives, reimbursement, and compensation incur F&A and are shown as a line item in the 53 account. While these funds are not restricted, it is important that charges to the award are in-line with payments approved by RICRO and by the sponsor.

Side-by-Side Comparison

The table below shows a side-by-side comparison of participant support and incentive costs.

| Participant (Trainee) Support | Participant (Human Subject) Incentives |

| Award benefits the participant | Award motivates the participant |

| Primarily non-CSU employees | May include CSU employees & non-employees |

| No F&A incurred | Incurs F&A |

| Generally allowable with sponsor approval | Generally allowable with sponsor approval; incentives should be included in human subjects’ protocol |

| Sponsor approval required to reallocate funds | Sponsor approval may or may not be required to reallocate funds |

| Payments are taxable to the recipient | Payments may be taxable to the recipient |

| Payments via student account or disbursement voucher (DV) | Payments made in accordance with FPI 2-10 (Research, Survey, and Other Related Incentives) |

For more on participant support versus incentive costs, refer to:

- OSP blog Incentive Payments

- OSP guidance Participant Support Costs

- The University of New Mexico’s Participant Support vs Incentive

Blog post by Tricia Callahan, Kim Melville-Smith, and Chris Carsten, Office of Sponsored Programs.